Presidential Decrees, Recessions and Bear Markets – Common Sense Treasury

A reader asks:

Which presidential candidate is more likely to cause a recession/bear: Trump or Harris?

Obviously, this question came up before we got the results of the election but my answer would be the same no matter who wins.

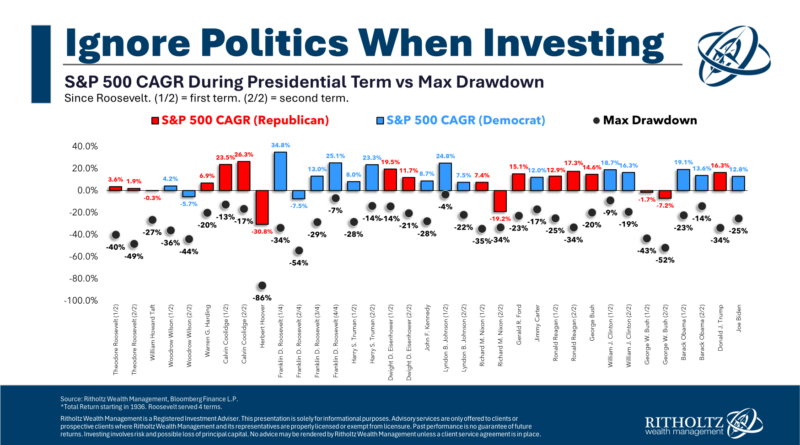

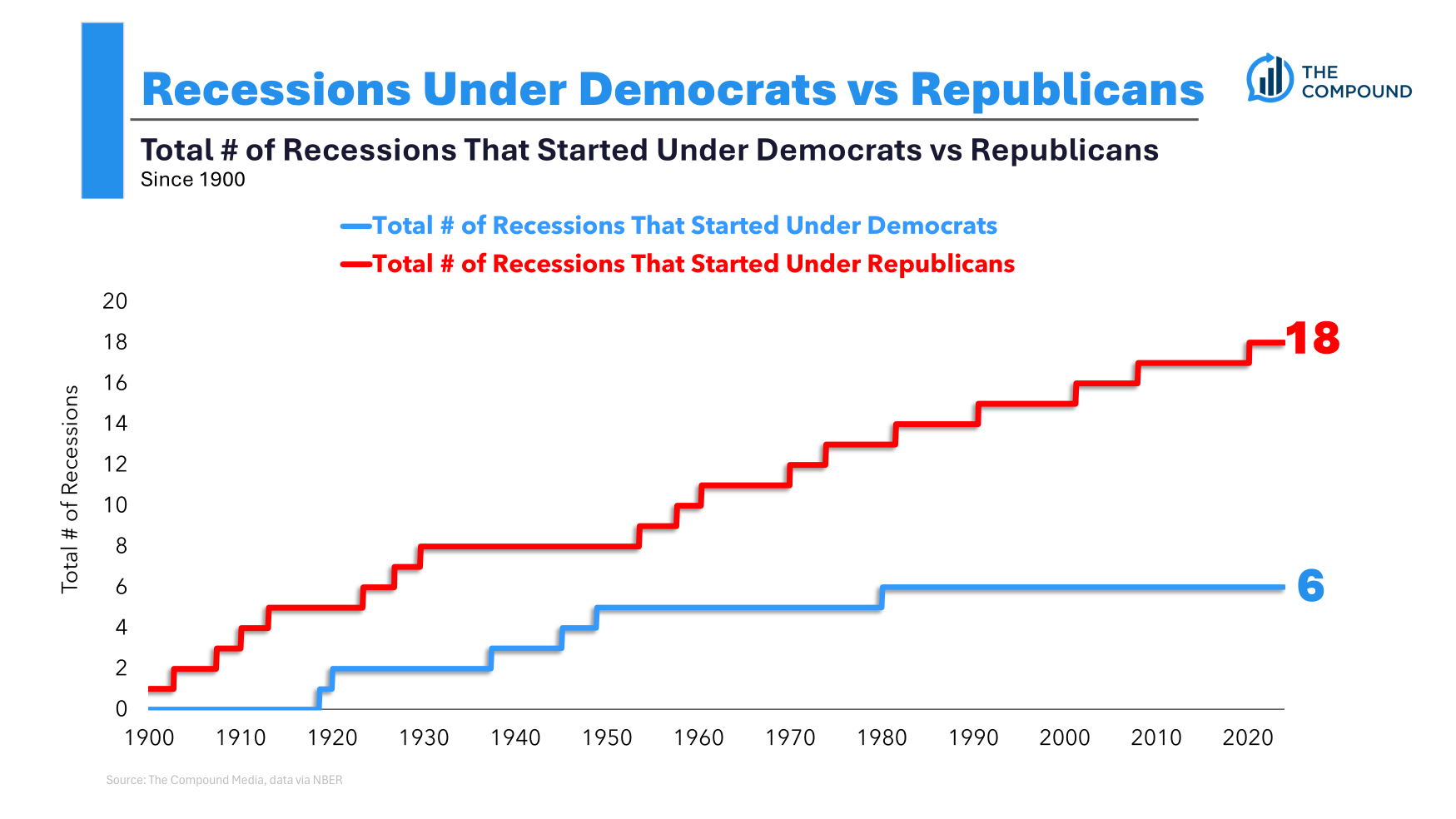

Here’s a look at the biggest declines in presidential terms going back to Teddy Roosevelt:

Some are worse than others but it can be difficult to point to any kind of correlation between presidents and stock market crashes.

I believe we will have a major correction or bear market at some point in the next four years. The president can’t stop the stock market from going down. It just happens.

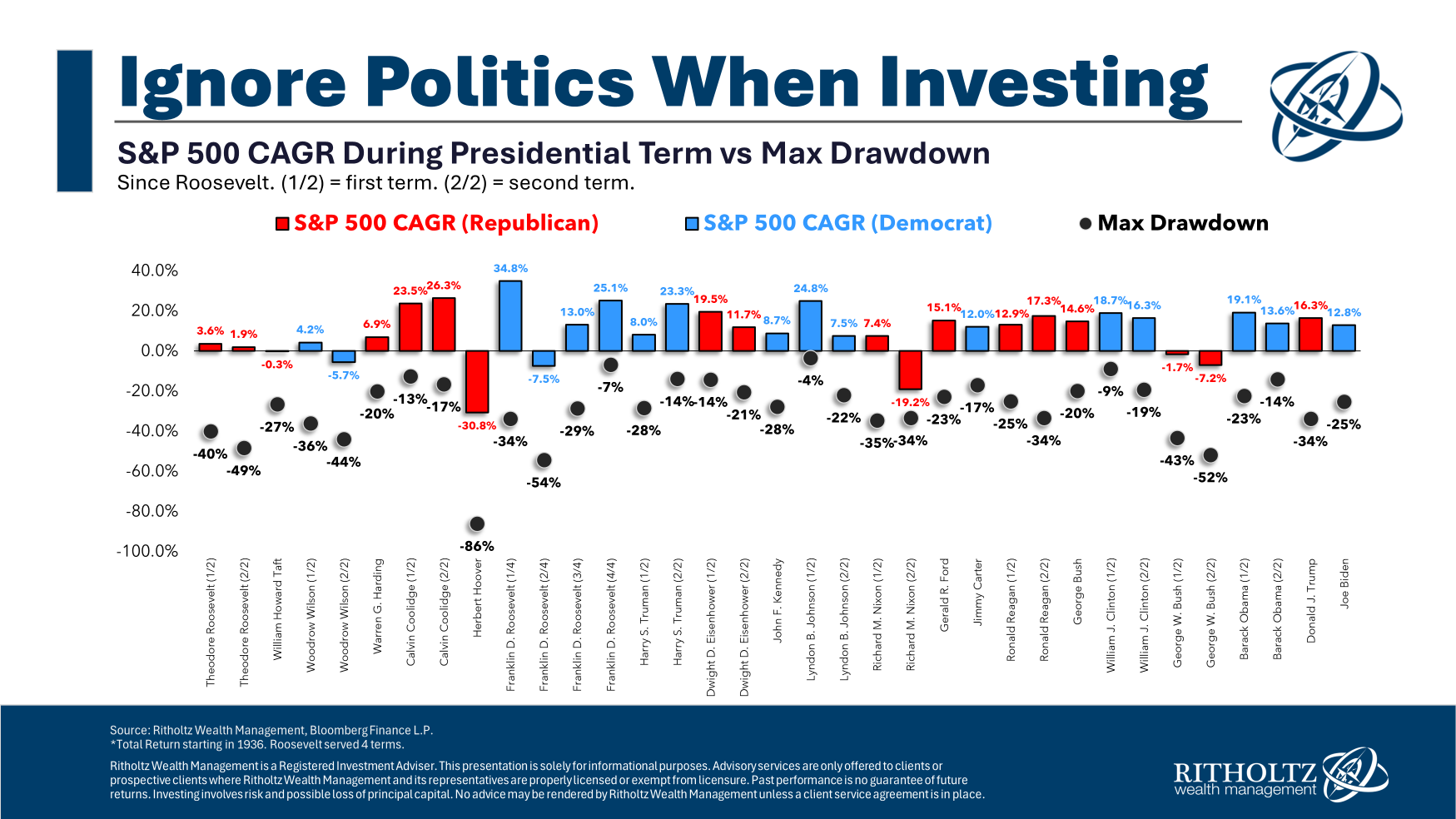

In terms of recessions, here’s a look at how they stack up on a systematic and long-term stock market chart:

It is clear that there were more recessions in the pre-WWII era than in the modern economic era.

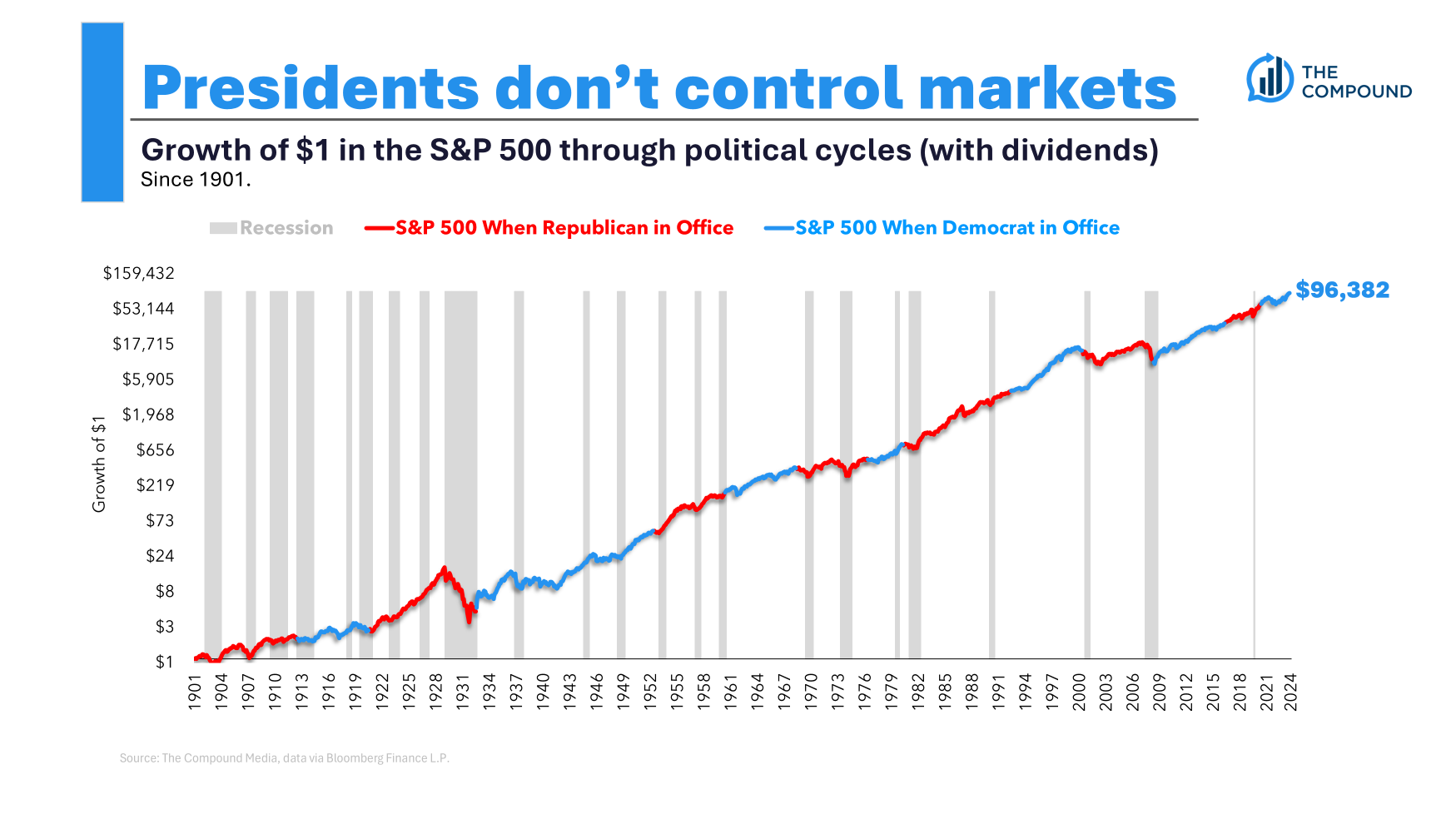

I also had our research team look at the number of recessions started by two political parties:

I am surprised here. There have been more recessions that started during Republican presidential terms than Democrats.

However, I don’t think this really tells us anything. Text is needed here.

Was Ronald Reagan an economist, or did he take time out during the recession and low interest rates?

Was George HW Bush a terrible student of finance or did his election fall during the recession?

Was Bill Clinton an economist, or did he happen to lead the country during economic nirvana, good demographics and the dot-com bubble?

Was George W. Bush bad in the economy or did he just happen to take office from the 20 year bull market and the two biggest bubbles in history (stocks and housing )?

Were Obama and Trump financiers or were they future presidents focused on economic recovery, technological breakthroughs and the low-end environment?

Did Joe Biden himself drive up the stock market and housing prices or did the epidemic of binge drinking cause the boom in the 2020s?

You can nitpick if you like and point out certain policies and decisions made or not made but the point is that these things are cyclical. Sometimes presidents are lucky or unlucky depending on when they enter office.

So will Trump get lucky or unlock the next four years?

On the other hand, we have had exactly one recession in the last 15 years and it only lasted two months. You can say we have to go bankrupt (regardless of who the president is).

On the other hand, check out the current setup he’s in:

- Unemployment rate 4.1%

- Inflation rate 2.4%

- 10-year treasury rate 4.4%

- Real GDP growth 2.8%

If there is such a thing as a sweet spot for the US economy, we are in it now. Plus, you have the Fed at your fingertips.

Of course, that won’t last forever. Now, there is the prospect of higher prices if Trump carries out his tariff plans. But we’ve just lived in an era where high inflation didn’t lead to recessions and spirals.

If the past three years have taught us anything about the economy it is that predicting a recession is difficult.

It’s difficult when you use economic data. It’s difficult when you use the stock market or product lines as an indicator. It’s hard when you use vibes. And it’s difficult when you use politicians.

Recessions and bear markets are part of the financial system in which we operate.

You must consider them in your investment plan.

But that doesn’t mean you have to predict them.

We covered this question in this week’s Ask the Mix:

Bill Artzerounian joined me on this show this week to talk about the impact of the election on your taxes, the challenges of early retirement, tax planning for retirement and when to fill Roth buckets for of retirement savings.

Further Reading:

Some Things I Don’t Believe About Investing

This content, which contains opinions related to security and/or information, is provided for informational purposes only and should not be relied upon in any way as professional advice, or endorsement of practices, products or any services. There can be no guarantee or warranty that the opinions expressed herein will be applicable for particular facts or circumstances, and should not be relied upon in any way. You should consult your own advisors regarding legal, business, tax and other matters related to any investment.

Comments on this “post” (including any related blogs, podcasts, videos, and social media) reflect the views, opinions, and reviews of Ritholtz Wealth Management employees who provide views are, and should not be construed as, the views of Ritholtz Wealth. Management LLC. or its various affiliates or as a description of the advisory services provided by Ritholtz Wealth Management or the performance returns of any client of Ritholtz Wealth Management Investments.

References to any assets or digital assets, or performance data, are for informational purposes only, and do not constitute an investment recommendation or offer to provide advisory services regarding investment. The charts and graphs provided within are for informational purposes only and should not be relied upon in making any investment decision. Past performance is not indicative of future results. The content only refers to the date shown. Any values, estimates, projections, expectations, expectations, and/or opinions expressed in these articles are subject to change without notice and may differ or contradict the opinions expressed by others.

Compound Media, Inc., a subsidiary of Ritholtz Wealth Management, receives payment from various agencies for advertisements on affiliate podcasts, blogs and emails. The inclusion of such advertisements does not imply or imply endorsement, support or encouragement thereof, or any association with it, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Financial investments involve the risk of loss. For additional advertising disclaimers see here: https://www.ritholzwealth.com/advertising-disclaimers

Please see the disclosures here.

#Presidential #Decrees #Recessions #Bear #Markets #Common #Sense #Treasury